Shipper | Market updates 3 min. read

Mexico cargo theft is a pain point for shippers – what can you do to mitigate your risk?

Leverage Schneider’s 99.99% cargo theft-free load rate.

Trailer theft and cargo disappearance in Mexico has historically been one of the biggest pain points for U.S. shippers and their cross-border logistics service providers who are receiving international raw materials through Mexico and/or manufacturing in Mexico.

According to Overhaul’s 2024 Mexico Cargo Theft Report, the average annual cargo theft reported by authorities ranges between 13,000 and 14,000 events.

45% of cargo thefts in Mexico are the states of Puebla with 23% of cargo thefts, and Mexico with 22%.

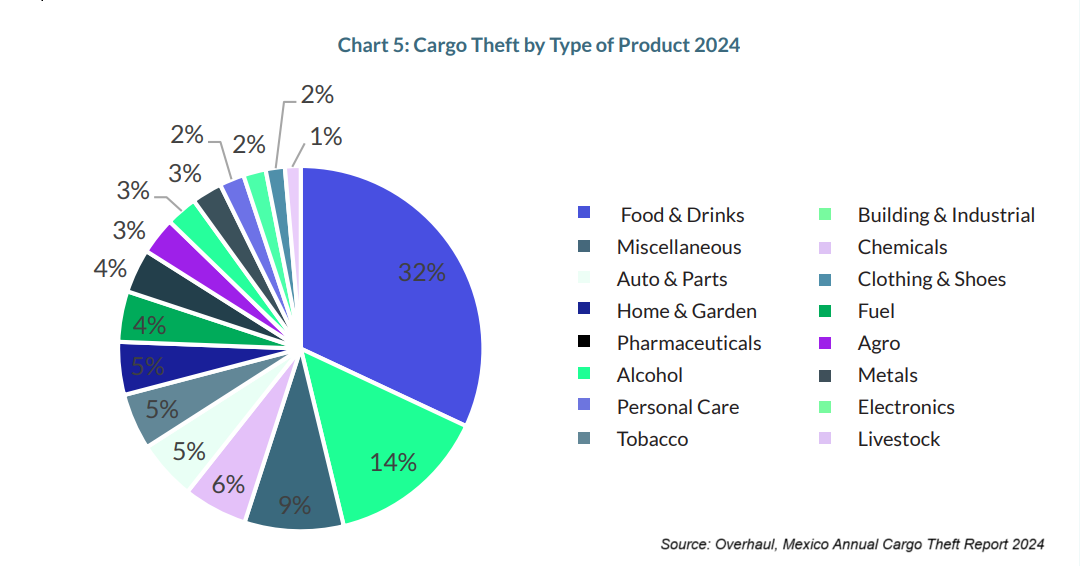

The most stolen commodity in 2024 was food and drink, being 32% of cargo thefts. The next most stolen commodity is building and industrial materials at 14%.

What can shippers do to mitigate the risks of cargo theft in Mexico?

Hijackings and cargo disappearance can completely shut down supply chains. It’s extremely important to work with the right carriers that have a safety and security first mindset. While it is impossible to prevent the growing threat of cargo theft, in order to help mitigate the risk you should consider looking for carriers that have:

- Technology offering visibility, tracking and notification.

- C-TPAT certification – both themselves and any third-party carriers they have moving your freight.

- Committed and non-stop capacity options such as dedicated and intermodal.

- Trailer and container securement solutions.

- Cargo liability insurance options.

How Schneider protects Mexico freight

As one of the most secure cross-border transportation providers, with a cargo theft-free rate of 99.99%, shippers come to Schneider’s team for our expertise in the topic.

High-tech visibility, tracking and notification

Schneider offers real-time shipment tracking across all modes, which include in-cab and on-trailer. In-cargo tracking is an option as well.

Beyond the basics, Schneider also works with Overhaul to provide an additional level of security for those who need it, adding GPS tracking shipment and monitoring, predicative theft mitigation and prevention, extra securement devices, connection to law enforcement and cargo insurance.

Schneider also collaborates closely with our third-party providers to ensure strong safety measures are upheld throughout our extensive Intermodal network.

C-TPAT certification

Schneider and the 40+ third-party truckload carriers that it utilizes in Mexico are C-TPAT certified, helping to keep customer freight moving safely, securely and quickly to its destination, with FAST Lane access at the Laredo border.

Non-stop capacity

Beyond C-TPAT certification, our truckload and Dedicated freight moves quickly and securely in Mexico until it reaches the border.

Intermodal capacity solutions are offered throughout the manufacturing belt of Mexico, which are more secure than truckload as the freight moves long distances without stopping and is often composed of two stacked containers on the railroad. We also have priority placement with the CPKC, whose security practices are top-notch and also has a 99.99% theft-free security record.

Cargo liability for peace of mind

Liability Law is significantly different between the United States and Mexico. In Mexico, liability is limited by statute to a significantly reduced amount which, at present time, translates to only about $1,750 USD in coverage for an average 40,000-pound trailer, when in the U.S., coverage is typically for at least $100,000.

To provide peace of mind, customers can obtain additional cargo insurance by working with their Schneider representative.

Enhance your cross-border freight security

Find key strategies to the top cross-border shipping challenges in this free guide.

Related resources

Drive your business forward

Sign up to receive our industry leading newsletter with case studies and insights you can put to use for your business.