Shipper | Best practices 11 min. read

What to look for when choosing an intermodal carrier

Get the most out of intermodal shipping and better manage your supply chain by choosing the right intermodal carrier.

Nine important intermodal carrier traits to look for

Increased consumer demand and the mounting pressure for companies to institute sustainable shipping practices has shippers turning to intermodal to move their goods — and with good reason: It’s cost-effective (and most beneficial) when freight moves 300 miles or more, goes to the same metro location consistently and shippers are within 250 miles from a ramp.

To get the most out of intermodal shipping and mitigate the headaches of managing your supply chain, it’s crucial to choose an intermodal carrier that can guarantee capacity, find efficiencies and give you more control over your freight. Look for these nine intermodal carrier traits for strategic and cost-efficient intermodal shipping.

Holds long-term, strategic relationships with rail providers

When a transportation and rail provider routinely collaborate, they develop a strategic working relationship. But that magic doesn’t happen overnight. It’s the result of the provider committing to consistent, regular volume of freight throughput. And when the transportation provider’s network complements the rail provider’s, the overlapping footprint makes for easier and more efficient freight moves. Over time, the two form a mutually beneficial relationship, which helps a carrier with securing capacity and getting freight moved with less risk of being bumped to the next departure.

For this relationship to form, the rail needs to know it can rely on a carrier to provide a specific amount of volume regularly. The carrier is then given that capacity before other third-party providers even get to request what they need. The carrier gets priority until that capacity threshold is reached, and if the carrier needs more, it has the credibility to request additional placement based on past freight volume reliability. During changing market conditions or an unexpected surge, an established carrier can flex its capacity needs within a larger window of time. The rail will work to prioritize and accommodate the request before turning to less-established carriers looking to change their capacity needs.

An intermodal carrier without an established relationship is typically unable to secure timely placement on the train, let alone enough capacity. This setback can result in several days tacked on to the shipping duration. Schneider services all of North America, with over 45 ramp locations, and strategic relationships with the Union Pacific (UP), CSX and Canadian Pacific Kansas City (CPKC) railroads give shippers that coveted priority placement and capacity on all top lanes. Plus, Schneider’s relationship with CPKC’s north-south flagship intermodal service between Chicago and all major points in Mexico solves for the needs of shippers moving freight cross-border. This is especially beneficial for the increasing number of manufacturers that are nearshoring their production to Mexico and moving goods north into the United States.

Continuously invests in shipping equipment for guaranteed capacity and visibility

When demand for capacity increases, so does demand for equipment. And when every pound and inch matters, the right equipment becomes even more essential to maximize intermodal capacity. Unfortunately for shippers and intermodal carriers alike, rail companies focus more on optimizing their networks than they do supporting them with intermodal shipping equipment.

Chassis

It’s important to leverage an intermodal carrier that owns and maintains its own inventory of chassis. Shippers should avoid working with intermodal carriers that rely on a shared chassis pool, as there is uncertainty in equipment availability, consistency and reliability.

- Availability: In the shared pool, the demand is often greater than the supply. If there aren’t enough chassis available at the ramp, product will sit, causing costly delays.

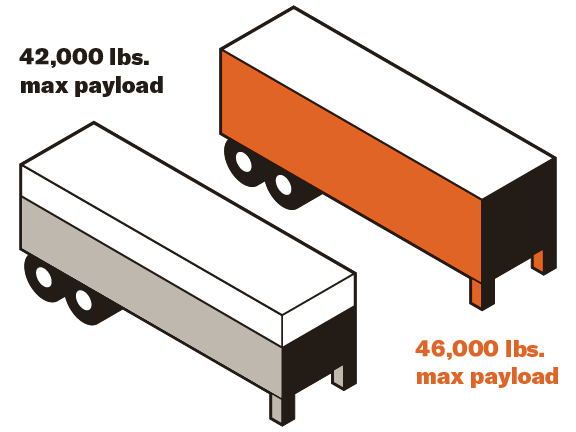

- Consistency: Chassis have varying weights — up to a 700-pound difference between models. To avoid fines, shippers have to assume that they’ll get a heavy chassis, which limits the payload. Schneider has a standard chassis that is 700 pounds lighter than the lightest chassis in the shared pool. This allows customers to move up to 46,000 pounds of product — up to a 10% increase in payload.

- Reliability: The shared pool doesn’t guarantee peak operating condition of its chassis, making breakdowns a common occurrence. A provider with owned assets, like Schneider, is more vigilant with monitoring the maintenance of its chassis fleet. Issues are identified and repairs made before they become too costly to fix — or need to be replaced altogether. Schneider, specifically, has a maintenance presence at almost all of its rail ramps, maintaining a 97% availability on chassis. Additionally, Schneider has approximately 100 service trucks that visit rail facilities and customer locations. This allows Schneider to have first priority of repairs, instead of having to call a vendor for maintenance.

When moving freight with providers who rely on the chassis pool, shippers have a much higher chance of experiencing unnecessary fees, delays and accidents than they do when using providers with their own chassis.

Shipping containers

Strategic shippers using intermodal should prioritize providers that heavily invest in their own shipping containers. It’s a sign of assured freight capacity, as well as increased care in ensuring no goods are damaged along the way.

The size of freight containers can greatly impact the cubic capacity of the load and overall transportation costs. Cubing out is common, but pinwheeling pallets can increase the capacity of the load. A pinwheeled configuration is when the direction of every other pallet is altered. A common interior container width is 98 inches, which leads to cubing out sooner. However, transportation providers with containers that have more than 100 inches of interior width more easily allow pinwheeling. This increases the amount of freight moved per load and decreases transportation costs due to fewer overall loads moved. Schneider’s intermodal containers are 53 feet long with an interior width of 100.375 inches — easily accommodating the needs of shippers looking to maximize their loads.

Manages dray transportation with its own team of professional, safe drivers

The driver shortage has been a top trucking industry issue for many years, and it’s showing no signs of stopping. In fact, American Trucking Associations estimates that the industry shortage is expected to surpass 160,000 drivers by 20301. High demand, fewer new drivers entering the industry and Baby Boomer driver retirements are all contributing factors. While no transportation provider is left untouched by the shortage, companies that employ drivers versus moving freight strictly through third-party capacity are more vulnerable.

Brokers may not be able to secure a driver when a shipper needs a load moved since they don’t have their own driver associates at the ready. Transportation providers with their own drivers are better able to meet shippers’ on-demand needs — even in a tight market.Safety is also a crucial component to moving freight. Without question, drivers need to be trained to safely handle their truck, in- and out-of-cab technology and the freight itself. Shippers should look for transportation companies that go above the federal law in screening and training their drivers. One example is requiring urinalysis and hair follicle testing to remove unqualified candidates. Companies that invest in hair testing and monitor and treat sleep apnea in their drivers indicate advanced safety measures, so shippers can be assured freight is moved safely, securely and legally.

Has a dedicated load engineer for unmatched optimization and safety

To further help optimize loads, ask whether the transportation provider has a load engineer on staff. A load engineer oversees and supervises outbound freight, analyzing loads and determining the most efficient and safe ways for them to move. They have advanced knowledge of how to best optimize a container to maximize payload while also keeping safety in mind. In some instances, they will design and build special structures to ensure maximum payload and safety.

After analyzing the freight and determining the best way to maximize the space of the container, a load engineer must also consider the physical forces that affect a load during transit. Vibration and shock are the two main ones that affect freight during rail transportation, both of which occur continuously throughout the journey. Failure to control these forces can jeopardize the safe, damage-free movement of the freight. The load engineer will apply the best blocking and bracing measures based on the configuration to mitigate freight damage, and by extension, costly claims. Depending on the type of freight and how it’s loaded, multiple methods may be used to keep freight in place for maximum security.

Facilitates a thorough onboarding process to mitigate freight mismanagement

No shipper wants to regret the decision to switch providers. A key factor in a successful transition is selecting an intermodal carrier that offers a step-by-step onboarding process with specially trained intermodal new business team members. To ensure business is set up for long-term success, shippers should be asking their potential providers:

- How do you plan to align our network?

- Is there a single channel of communication?

- Are there regular check-ins?

- What resources do you offer to help become a shipper of choice?

Builds personalized solutions

Large carriers are able to fold their enterprise around a shipper to create a solution that’s optimized for the freight. A carrier with a breadth of modes can look at the shipper’s network holistically and provide a recommendation that makes sense. This includes finding the best lines of service that fit the network and supply chain. When a shipper is able to see all of its options, it won’t get forced into a solution that doesn’t quite fit. Ultimately, the carrier can provide recommendations that include a mix of modes and providers to mitigate risk and help ensure freight keeps moving.

Schneider employs this through its capacity stacking model. This model follows a two-pronged approach. First, shippers have the benefit of using different services, technology and modes of transportation within their supply chain to drive more efficiency, productivity and cost savings. Second, shippers have access to supply chain management services, such as personalized logistics engineering, innovative technology stacks, digital optimization tools and dynamic pricing solutions to further unlock and realize supply chain strategy, agility and resiliency.

Offers enhanced communication and freight visibility options

Smaller shippers might be hesitant to work with a large transportation provider because they fear that the level of service and communication will be less than what larger shippers would receive. However, larger transportation providers who care about all their customers, regardless of their size, should have the resources and technology to keep shippers updated and informed. A key place to start is finding an intermodal transportation provider that assigns you an individual customer service representative (CSR) who will be your go-to point person. The CSR will help provide a more personalized experience since they are dedicated to your account.

Another core component is finding a provider with a variety of communications systems that can be put in place to match the level of communications you’d prefer. A critical piece of equipment for safely and efficiently moving freight is the use of satellite tracking for door-to-door visibility. As the supply chain becomes more complicated, the importance of real-time visibility cannot be overstated. These days, it’s becoming less of a nice-to-have and more of a must-have.

Complete freight visibility for intermodal moves is harder to achieve, making it a true differentiator when a transportation provider can deliver that clear line of sight into a shipment’s status. The key benefits for shippers include real-time, pertinent details regarding delivery status, delays and pending penalties. Your intermodal transportation provider should be embracing GPS tracking technology to achieve complete asset visibility for improved security and mitigated risk of lost equipment. In connection with an API, automatic order updates can be sent, eliminating status concerns and the need for freight status requests.

Schneider FreightPower®, an online marketplace for instant access to capacity, is available for intermodal loads, allowing shippers to independently quote, book and track a load. This provides complete freight management and visibility with 24-7 tracking and notifications.

Having real-time analytics available helps shippers optimize intermodal operations, further enhancing their supply chains.

Provides localized expertise

Whether a shipper needs two loads moved a week or 200, it should use an intermodal provider that can provide localized expertise and supply chain recommendations. For example, Schneider deploys field operations associates onsite to a shipper’s facility for onboarding meetings to thoroughly understand the business and the freight being moved and offer insight on the local transportation scene. This helps ensure that all shippers are receiving a more personalized experience, which helps facilitate transportation success.

Focused on sustainable transportation

Transportation is one of the top areas of improvement shippers cite when trying to reduce their environmental impact, and shipping intermodal can help meet those sustainability goals. Switching from truckload to intermodal can reduce emissions an average of 30%, making it the most sustainable mode for shippers.

In addition to helping customers meet sustainability goals, responsible transportation providers are turning inward and identifying opportunities to be more sustainable. Corporate Responsibility Reports are made publicly available to show shippers the organization’s approach to environmental governance. These reports show the progress against stated goals and reinforce the importance of sustainable efforts. While electric trucks are still a relatively new technology in the transportation landscape, their presence is gaining momentum. Integrating nearly zero-emission vehicles into a fleet is another way to reduce CO2 output.

Ultimately, the most important action strategic shippers can take is to ensure they’re using an established, strategic intermodal shipping provider. In doing so, they’ll obtain flexible, consistent capacity and know that they have a smart provider working on their behalf to find efficiencies and move freight safely.

Choosing the right intermodal provider

Get more information on what to look for when evaluating an intermodal carrier for your business needs.

Related resources

Drive your business forward

Sign up to receive our industry leading newsletter with case studies and insights you can put to use for your business.