Shipper | Market updates

Mexico Transportation Market Update

Q2 Mexico Transportation Market Update: The latest on what’s happening in Mexico including growth, events and cargo security

Mexico Cargo Theft and How to Mitigate Your Risk

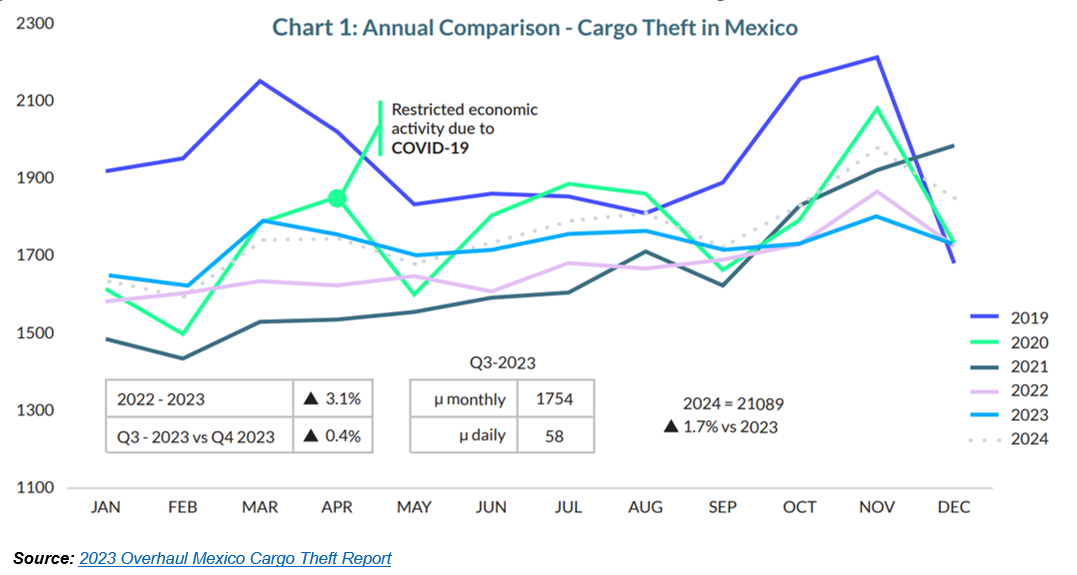

- The 2023 Overhaul Mexico Cargo Theft Report shows a 3.1% increase in cargo theft from 2022 to 2023.

- Q1 2024 statistics show a 1.4% increase in cargo thefts vs. Q1 2023.

- The most stolen commodities tend to be food and beverage.

Schneider has a 99.99% theft-free load rate, while transporting more than 9.4 million miles per day. Learn how Schneider can help you to take actions to mitigate your cargo theft risk.

Schneider Featured in T21 Magazine

Schneider’s Strategic and Long-Term Vision in Mexico

T21 Magazine recently covered Schneider in their June 2024 issue. Learn more about how Schneider’s 32 years in the Mexico market has been creating value and innovation for shippers – and is helping shippers now achieve their goals through nearshoring.

2023 Corporate Responsibility Report

About the Mexico transportation market update

Schneider publishes this regular transportation market update to keep you informed of freight market conditions, supply and demand influencers, and disruptions that may impact your supply chain.

This report is developed by leveraging data and analytics from multiple transportation industry resources.

This report focuses on the Mexico Transportation Market. View the full Transportation Market Update here.

Weather advisory page -- For the latest information on hurricane season and the impacts on supply chains, please see our weather-advisory page.

Drive your business forward

Sign up to receive our industry leading newsletter with case studies and insights you can put to use for your business.